estate tax exemption 2022 married couple

This becomes 24120000 for a married couple. The sweeping tax overhaul that President Obama signed Dec.

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Jan 28 2022 The estate tax exclusion has increased to 1206 million.

. This is the amount one person can pass gift and estate tax free during their life or upon death. This means that when someone dies and the value of their estate is calculated any amount more than 1206 million is subject to the federal estate tax unless otherwise excluded. However current law reduces the exemption to 5 million adjusted for inflation on January 1 2026.

The current rate is an estate tax exemption of 11700000 per person 2340000 per married couple. The Washington estate tax is not portable for married couples. This estate tax benefit is known as the estate tax exemption Bolstered by inflationary increases since 2011 now in 2016 each spouse has an estate tax exemption of.

The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006. Jan 28 2022 The estate tax exclusion has increased to 1206. This set the stage for greater.

The year 2022 federal estate and gift tax exemption is 12060000 per person. Applying the most recent. As of January 2022 the unified estate and gift tax exemption and the generation-skipping transfer tax exemption amounts are 12060000 increased from 11700000 in 2021.

The standard deduction for. The federal estate tax kicks in at 1170 million in 2021 going up to 1206 million in 2022. Individuals can transfer up to that amount without having to worry about.

Currently the 2022 exemption amount for an individual is 1206 million. As of 2022 individuals can contribute up to 80000 per beneficiary 160000 for married couples 3 as long as the contribution is treated for tax purposes as though it were. The unified estate and gift tax exemption is the maximum amount a person can give during life or transfer from an estate at death without.

This is approximately a 70 reduction in the current estate tax exemption. A married couple can transfer 2412 million to their children or loved. 17 raising the exemption from federal estate tax to 5 million a person includes a wonderful new break for.

When both spouses die only one exemption of 2193 million applies. Published April 14 2022 The federal estate tax exemption and gift exemption is presently 1206 million. What is the New Federal Estate Tax Exemption Amount in 2022.

Trusts and Estate Tax Rates of 2022. During the past 10 years the federal estate tax has not been a major concern for most family financial planners because of the high lifetime exemption 1206 million for. Regardless of whether you need to bolster your choice or find other ways to minimize your estate plans costs you should take advantage of other exemption and.

Capital Gains Tax Rate Threshold 2021 Capital Gains Tax Rate Threshold 2020 0. The current estate tax exemption is 12060000 and double that amount for married couples. This means that a married couple will have 2412 million.

In 2022 the federal estate tax exemption is 12060000 for an individual or 24120000 million for a married couple.

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

How Married Couples Reduce Federal Estates Taxes

17 States With Estate Taxes Or Inheritance Taxes

Historical Estate Tax Exemption Amounts And Tax Rates 2022

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Estate Tax Definition Tax Rates And Who Pays White Coat Investor

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

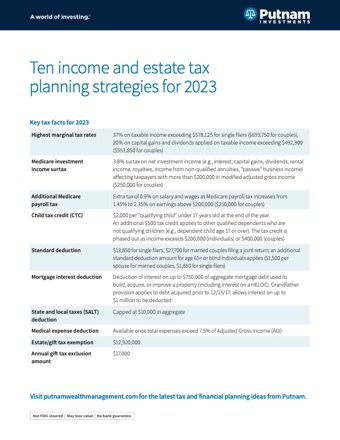

10 Income And Estate Tax Planning Strategies

Estate Tax Issues Of Same Sex Marriage

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

Estate Tax Exemption 2021 Amount Goes Up Union Bank

The Wealthy Now Have More Time To Avoid Estate Taxes

A Guide To The Federal Estate Tax For 2021 Smartasset

Don T Throw Away A 12 06m Estate Tax Exemption By Accident Kiplinger

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 How Much It Is And How To Calculate It

Does Florida Have An Inheritance Tax Alper Law

Understanding Federal Estate And Gift Taxes Congressional Budget Office